Positioning Albuquerque for the Future

General Obligation bonds require approval by the voters and are repaid from a portion of the property taxes. The current tax (mil levy) for AMAFCA general bond obligation is 67.5 cents per thousand on debt service for AMAFCA. An owner of property assessed at $100,000 would pay $67.50 in debt service on these bonds. Because old bonds are being retired as the new bonds are requested, passage of the bonds does not result in a property tax increase. AMAFCA holds a “natural triple-AAA” rating, the highest possible. This AAA rating saves taxpayers money by keeping bond interest rates as low as possible. With less spent on interest, more money is available for project development and construction – money that goes directly into the Albuquerque economy.

The AMAFCA Project Schedule identifies possible projects that could be constructed using the Bond proceeds. The current Project Schedule can be found here. The Project Schedule utilizes various criteria to establish general project priorities from a technical perspective, which may not necessarily reflect the priorities used by the Board of Directors for funding and construction of individual projects. Specific projects will be funded and scheduled by AMAFCA Board action based on evaluation of public safety needs, cost-sharing benefits, orderly development of flood control infrastructure, overall community needs, and regional planning requirements.

AMAFCA General Obligation Bond Program

The AMAFCA Bond Program is vital to our community’s future economic development by addressing priority infrastructure needs, improving quality of life, improving community health, public safety, the environment, and resiliency.

Over the last six years, the AMAFCA Capital program has contributed to the local economy, $118,200,000 or an average of 19 million dollars a year, funding studies, design and construction of flood control and water quality facilities in the urban area supporting over 800 local jobs.

Currently AMAFCA has $48,000,000 of outstanding debt and has a statutory limit of $80,000,000, therefore AMAFCA has $52,000,000 of debt capacity in reserve. The AMAFCA Bond Program works with the investment community to ensure a predictable debt repayment strategy, as a result, AMAFCA has held its debt service mill levy to 0.675, unchanged since 1999.

Project Schedule

The Bond Program will fund projects identified in the AMAFCA 2022 Project Schedule. The Project Schedule includes 65 projects, categorized as follows: 31% Drainage deficiencies in existing neighborhoods; 15% Rehabilitation of existing flood control facilities; 42% Master planned drainage facilities; and 12% Storm water quality projects (retrofits and new projects).The 2022 Bond Program will fund specific projects approved by the AMAFCA Board of Directors by Board action based on an evaluation of public safety needs, cost-sharing benefits, orderly development of flood control infrastructure which addresses overall community needs and regional planning requirements. This is an ongoing process, below are a few examples of the projects identified in the 2022 Project Schedule.

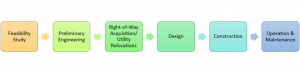

Project Lifecycle

Every flood damage reduction project is unique. Yet each project begins and ends, with common and predictable milestones along the way. Whether a project moves forward – and how quickly – depends on many factors, including the availability of funding at each milestone, shifting community priorities for flood damage reduction, and other changing circumstances (such as the price of steel or concrete) from year to year.

Throughout the lifecycle of each project, the Albuquerque Metropolitan Arroyo Flood Control Authority (AMAFCA) considers community desires and environmental considerations. For example, a project’s flood damage reduction target might be balanced against the community’s interest in sponsoring a hike-and-bike trail on AMAFCA property or in seeing a more aesthetically pleasing channel design. AMAFCA projects also may contribute to important environmental goals, such as habitat mitigation or stormwater quality improvements. While AMAFCA’s mission is to build and maintain flood damage reduction projects, the AMAFCA Board of Directors are committed to building those projects with an appropriate regard for the community and their fiduciary responsibility.

Steps of the Process

Feasibility Study – The need for a flood damage reduction project may be identified in various ways: a citizen suggestion, a county or city official’s request, or an AMAFCA conceptual analysis. Once a flooding problem is identified, the project moves into the first step of the project lifecycle – a feasibility study. The feasibility study usually involves further analysis of the flooding problem, communicating with the public and key stakeholders and determining major components of a possible plan to achieve flood damage reduction goals. This is often the stage when the public first learns about an AMAFCA project.

Preliminary Engineering – Once a feasibility study report has been approved, and if funding is available, the project moves into the project development or preliminary engineering stage. During this stage, AMAFCA engineers develop and evaluate possible alternatives, prepare a project development or preliminary engineering report that includes project recommendations that meet flood damage reduction goals. The report will identify needed right-of-way, identify potential utility conflicts, and develop a preliminary cost estimate for the recommended solution.

Right-of-Way Acquisition / Utility Relocation – Once the project development/preliminary engineering report is reviewed and approved by the AMAFCA Board of Directors, the project may advance to the right-of-way acquisition and/or a utility relocation stage depending on the project needs. The AMAFCA will either purchase property outright or acquire a specific-use easement for property needed to widen a channel or build a stormwater detention basin. In many cases, telephone, electricity, and gas lines must be moved out of the way. Again, cost and changing priorities may cause the project to be reevaluated.

Design – If the project continues to address current AMAFCA priorities, and if funding is available, the project moves into the design stage. During this stage, civil engineers prepare construction plans, specifications, and more detailed cost estimates. This stage may overlap with the previous stage of right-of-way acquisition and utility relocations since those activities may affect final design considerations. Periodic reviews presented to the AMAFCA Board of Directors may affect final design.

Construction – With a set of detailed construction documents in hand, AMAFCA may move into the construction stage, if funding is available. The AMAFCA Board of Directors will authorize this most visible stage of action, moving from the office to the construction site. The project will be bid and the AMAFCA Board of Directors will award the construction contract to a contractor. Projects may involve several construction phases and major projects may take years to complete.

Operation and Maintenance – Once construction is complete and final contracts have been closed out, the project becomes a facility requiring operation and maintenance. The now constructed facility becomes the responsibility of AMAFCA (or another governmental partner). Crews will mow, repair and otherwise maintain the facility.

Eventually, flood damage reduction facilities exceed their lifespan and need to be updated or replaced as part of the project lifecycle. Technological advances over the years also enable AMAFCA to upgrade our facilities. Future project modernization might include widening, deepening or restoring existing channels and dams, adding additional vegetation around a stormwater detention basin, or reconstructing waterways with natural channel design elements. Each flood damage reduction project is monitored and assessed as years go by to make sure it continues to support the goal of flood damage reduction consistent with community and natural values.

Frequently Asked Questions:

What is a general obligation bond?

A general obligation bond (G.O. bond) is a form of debt obligation that, when issued, provides Albuquerque Metropolitan Arroyo Flood Control Authority (AMAFCA) with funds to finance large capital improvements, such as those currently proposed to rehabilitate or build new flood control infrastructure or construct storm water quality improvements.

-

- G.O Bonds are a financing mechanism to fund improvements immediately.

- Bonds are backed by the full faith and credit of the issuing agency (AMAFCA)

- Repaid through the imposition of a dedicated debt service millage levy (Ad Valorem tax)

- A city-wide voter referendum is required prior to the issuance of GO Bonds

What can general obligation bonds be used for?

G.O. bonds allow AMAFCA to pay for major capital investments having a public purpose, such as dams, concrete and earthen channels, underground pipe, water quality improvement structures, and habitat improvements.

Bonds are sold to investors and the proceeds from the sale of these bonds are used to pay for capital projects. Bond funds cannot be used for everyday operating costs, such as salaries for AMAFCA staff. Such operating expenses are paid for by AMAFCA’s operational service millage levy.

Why does AMAFCA issue bonds to pay for AMAFCA projects rather than pay for projects with cash?

The AMAFCA Bond Program includes many planned and recommended large-scale projects throughout the Albuquerque urban area. Using bond financing to fund large-scale projects, in a period of relatively low interest rates and lower costs of borrowing (especially given the AMAFCA’s favorable credit rating), allows the annual AMAFCA operating budget to be allocated toward reoccurring costs such as maintenance, personnel, operations and public service programs.

How were bond-related projects selected?

The projects identified for this bond cycle are in-line with the 2022 AMAFCA Project Schedule. The Project Schedule came to fruition after a long-range planning process that took place from 2020-2021 and utilized a variety of needs assessment and engagement techniques with other government agencies to identify high-priority needs. The Project Schedule is updated every two years to reflect the changing needs of the community. The 2022 Bond Program will fund specific projects approved by the AMAFCA Board of Directors based on an evaluation of public safety needs, cost-sharing benefits, orderly development of flood control infrastructure which addresses overall community needs and regional planning requirements.

Can bond funds be spent on salaries for staff and elected officials, day-to-day business operations or events? What are authorized uses of bond funds?

No. Bond proceeds cannot be used to pay day to day operating cost. The proceeds can only be used to build and rehabilitate the flood control system including all infrastructure associated with AMAFCA. Studies, engineering reports, designs and construction projects are the authorized uses approved by the AMAFCA Board of Directors.

Will the debt service millage rate be the same every year?

Not necessarily, but the AMAFCA Board of Directors have strived to minimize fluctuations in the millage rate. The AMAFCA Bond Program produces the funds needed for infrastructure improvements in such a manner that has stabilized debt service. AMAFCA works with the investment community to insure a predictable debt repayment strategy. As a result, AMAFCA has held its debit service mill levy of 0.675, unchanged since 1999.

How is the debt service millage rate calculated?

The debt service millage rate is calculated using the County Property Appraiser Certified Taxable Values for Bernalillo County that is provided every July. That Taxable Assessed Value is then divided by 1,000 to arrive at the value of one “mill.” The millage levy in dollar value is then calculated by dividing 0.675 by 1,000 (to arrive at the value per thousand) and multiplying that by the property’s Taxable Assessed Value (not Market Value). In our median home value example, a home assessed at $100,000 ($300,000/3) would equal an annual payment of approximately $68 per year.

Has AMAFCA recently increased its property tax rate?

No. AMAFCA has held its debt service mill levy rate steady at 0.675 since 1999. AMAFCA’s current tax rate for debt is the lowest in Bernalillo County. AMAFCA manages its capital projects program carefully, so the AMAFCA Bond Program produces the funds needed for infrastructure improvements in a consistent and predictable manner.

How much property tax-supported debt does AMAFCA currently have?

Currently AMAFCA has $48,000,000 of outstanding debt. AMAFCA has a statutory limit of $80,000,000, therefore AMAFCA has $52,000,000 of debt capacity in reserve.

How will I know bond projects are being completed and funds are being used properly?

Transparency is of utmost importance to AMAFCA. AMAFCA staff update the AMAFCA Board of Directors on a monthly basis, during a public meeting, summarizing all bond proceeds expenditures including engineering design services and construction. The AMAFCA Board of Directors represents the population and provides oversight to ensure that bond funds are spent appropriately.

Election Information

-

New Mexico Secretary of State

- Toll Free: (800)-477-3632 or visit www.sos.state.nm.us

-

Bernalillo County Clerk’s Office

- (505) 243-VOTE or visit www.berncoclerk.gov